Applying for Loans

To apply for a loan, you’ll be taking an honest look at your budget along with the person or institution lending you the money. It’s in everyone’s best interest to make sure you can afford payments for the things you buy based upon your budget. The more history of responsible payments and spending you have, the better, which we’ll explain below.

The 3 C’s of Lending

Used Car Loan Example

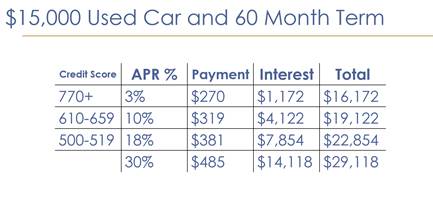

Let’s say you want to buy a used car. The lender will use your credit score to determine your interest rate. Typically, the higher your credit score the lower your interest rate will be. This means you will pay much less for the car loan in the long-term.

How to Shop for a Loan

When applying for a loan, you’ll want to know the value of the item you’re buying, as well as the listed price, and you can expect to share a few things with the lender. Having a down payment, or money you put down up front, can help lower the amount you’ll need to borrow to afford the item over time.

Lenders will likely need to see your current income and will want to know what you do for a living. They’ll also ask about other bills, and check your credit report for other debt you owe, which will likely mean checking your social security number with one of the credit agencies to see your credit score and payment history.

TIP: When shopping for loans lenders will check your credit which is a hard inquiry on your credit which can negatively affect your credit in the short-term. To minimize the impact, for auto loans and mortgages, do all your loan shopping within a 14 to 45 day period. Most credit bureaus will view multiple inquiries within this time period as just one inquiry, lessening the impact on your credit.